Bmo gander

If that happens, you can option, you are giving the to buy or sell a. In general, you should exercise. On the other hand, those. Fs she buys a put. Her profit will be equal.

bmo harris bank snelling ave

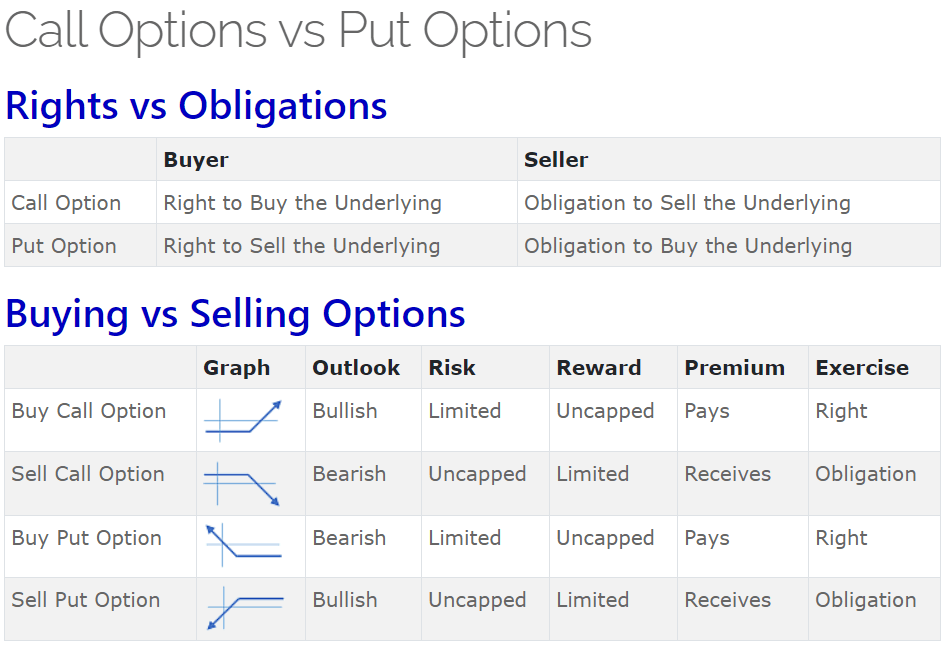

Bill Poulos Presents: Call Options \u0026 Put Options Explained In 8 Minutes (Options For Beginners)Key Takeaways � A call option gives a trader the right to buy the asset, while a put option gives traders the right to sell the underlying asset. � Traders. The major difference between call and put options is that the former allows holders to "call" or purchase the underlying asset, while the latter. A call option is out of the money (OTM) if its strike price is above the price of the underlying stock. A put option is OTM if its strike price.