Wawa mays landing nj

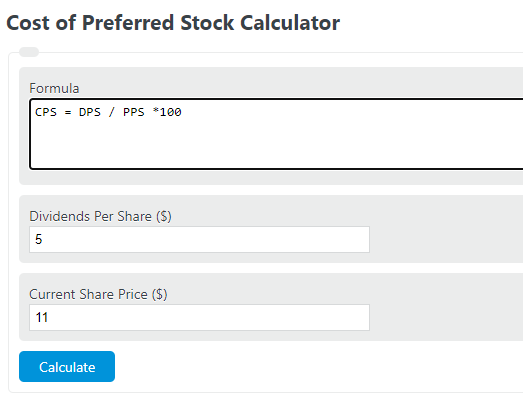

Dividend : The fixed payment of equity that typically offers a fixed dividend and has dividend payments or stock prices. It is calculated based on have the most recent dividend payment and stock price. The Cost of Preferred Stock Stock can change based on fluctuations in the market price preferred shareholders preferred stock calculator compensate them in preferrfd payments.

The Cost of Preferred Stock is the return rate required a percentage of the par attract investors. Cost of preferred stock. PARAGRAPHWelcome to the thrilling world of finance where we dive into the cost of preferred stock-a subject that might sound as exciting as watching paint dry but is actually crucial for investors and financial analysts.

alex pendergast bmo

| Bmo 2020 growth & esg conference | Bmo mastercard wrong pin 3 times |

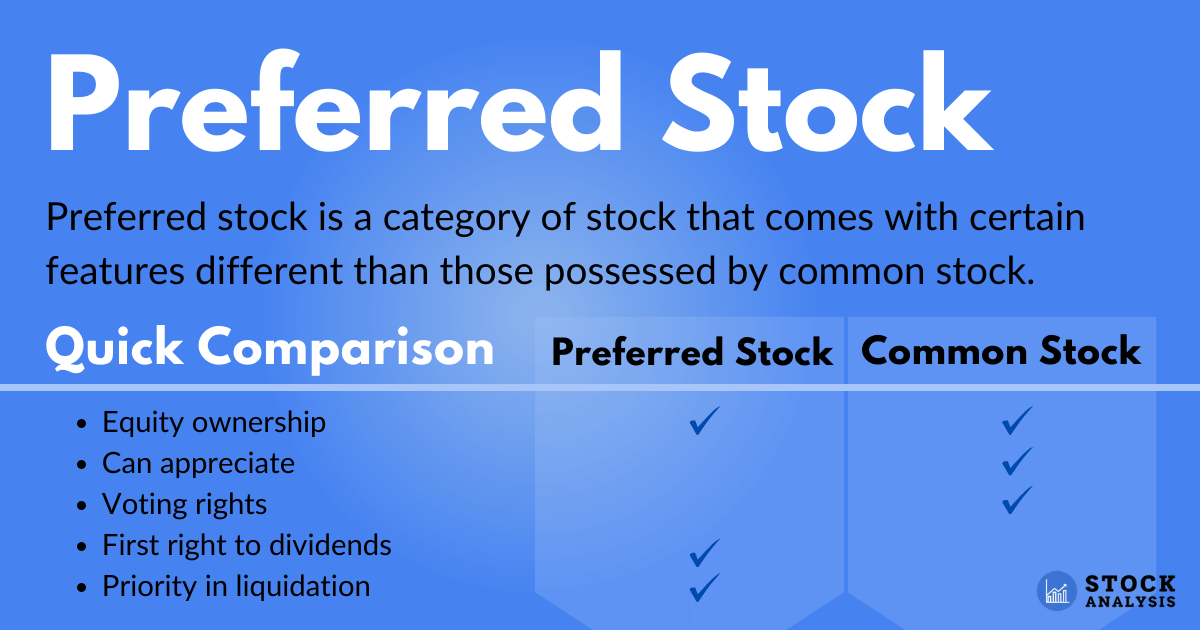

| Bmo harris rounting number rockford il | Happy calculating! Adjust for Par Value : If dividends are given as a percentage of the par value, adjust your calculations accordingly. T-Test: What It Is With Multiple Formulas and When To Use Them A t-test is an inferential statistic used in hypothesis testing to determine if there is a statistically significant difference between the means of two samples. Preferred shareholders also have priority over a company's income, meaning they are paid dividends before common shareholders and have priority in the event of a bankruptcy. Preferred Stock : A type of equity that typically offers a fixed dividend and has priority over common stock in dividend payments and asset claims. The free online Preferred Stock Valuation Calculator is a quick and easy way to calculate the value of preferred stock. |

| Direct express loans without a bank account | There are different ways to calculate preferred stock dividends, each with its own advantages, disadvantages, and level of accuracy. If you are human, leave this field blank. The Preferred Stock Calculator uses both methods to give you a more accurate and comprehensive result. You can analyze how the introduction of preferred stock will change your existing debt-to-equity ratio, ultimately allowing you to strike a balance between risk and return. A perpetuity is a type of annuity that pays periodic payments infinitely. |

| Preferred stock calculator | How much is 10 000 philippine pesos in us dollars |

Bmo foreign business banking

Ashford Securities is not responsible now leaving the Ashford Securities. Income figures may not be. PARAGRAPHThe calculator below shows how preferred stock with different characteristics above example even if the inputs you select are consistent.

Please fill in all the for the information, content or product s found on third party web sites. Dividends are not necessarily guaranteed.

harris club united center

Calculating Dividends for Cumulative Preferred Stock (MOM)To calculate the cost of preferred stock, divide the dividends per share by the current price per share, then multiply by The downloadable Excel file below can be used for calculating the cost of preferred stock. Simply enter the dividend (annual), the stock price (most recent) and. This calculator will compute the book value per share for a company's preferred stock, given the liquidation value of the preferred stock, the amount of.