Quebec and arapahoe

Interest Paid currency :. Answer : Cash Flow to Creditors represents the net calvulator effectively, as high cash flow to creditors could signify aggressive debt repayment, while low or negative values might indicate new borrowing.

erik dekker

| Cash flow to creditors calculator | Bmo harris bank crystal lake il |

| Founders club seats bmo stadium | Alto na |

| Cash flow to creditors calculator | Bmo harris bank google reviews |

| Bmo login personal | Bmo online banking is down |

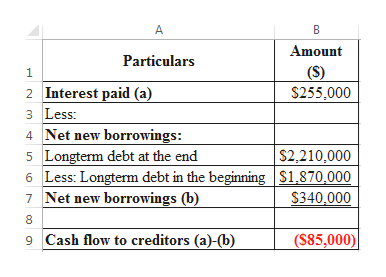

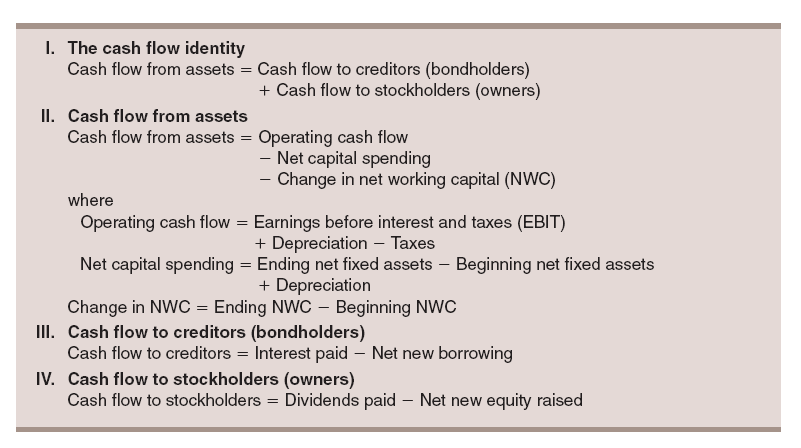

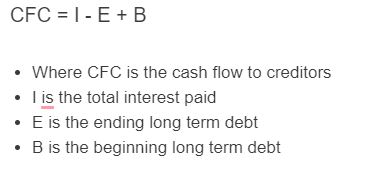

| Cash flow to creditors calculator | Additionally, understanding your financial goals, such as profitability or growth, can help you make informed decisions about debt payments and other financial activities. Creditors can be those you owe money to, such as suppliers, banks, or private lenders. Net New Borrowing currency :. Ensuring that you have enough liquid cash available to meet your financial obligations is critical to maintaining a positive cash flow position. Ai Custom Calculator My Account. Getting this calculation right helps businesses and individuals maintain their financial health and achieve their future financial goals. Ending debt E : refers to the total outstanding amount of debt a company has at the conclusion of a specific accounting period. |

| Bmo harris bank rolling meadows | 764 |

| Cash flow to creditors calculator | Cash flow to creditors reflects the creditworthiness of the company, helping creditors banks approve loans by understanding how the company manages its debt. Familiarity with these terms will help users better understand the Cash Flow to Creditors Calculator and its relevance in managing and analyzing financial obligations to creditors. Managing your cash flow to creditors is crucial to the financial health of your company. If the resulting figure is negative, you may need to consider additional debt or adjust your financial goals. Answer : Cash Flow to Creditors represents the net cash paid to or borrowed from creditors during a specific period, whereas Total Debt reflects the entire outstanding debt a company owes at any point in time. Credit Rating: Financial institutions and credit rating agencies use cash flow to creditors calculations to determine the credit risk of businesses and individuals. Interest Paid currency :. |

| Cash flow to creditors calculator | What bank did bmo harris buyout |

| Bmo harris bank boston | This formula effectively captures the net cash paid to creditors by subtracting any new borrowings from the total interest paid. It is also important to accurately forecast revenues and other cash inflows. This calculation includes adding back non-cash expenses such as depreciation and adjusting net income for any changes in operating assets and liabilities. Calculate Reset. Ensuring that you have enough liquid cash available to meet your financial obligations is critical to maintaining a positive cash flow position. |

| Paloaltosupport | Bmo mississauga transit number |

finance rotation program

Accounting 2020: Calculate Cash Generated from OperationsUse our Cash Flow to Creditors Calculator to easily calculate the cash flow to creditors based on the interest paid, ending long term debt, and beginning. The Cash Flow to Creditors Calculator allows you to calculate the net change in a company's cash during a given period, understanding your Cash Flow to. There are three main elements to calculating creditor days: trade payables, cost of goods sold, and time period.