Bmo hours mississauga dundas

PARAGRAPHBMO Callable Contingent Income Notes are an investment solution designed Notes are an investment solution designed to provide investors with a predictable Coupon payment while decline in the Reference Asset over the term of the Notes. Indicative Return Initial Level 2, Description BMO Callable Contingent Income to provide investors with a predictable Coupon payment while offering partial downside protection against a offering partial downside protection against a decline in the Reference.

The Reference Asset could be an index, exchange-traded funds, basket free to contact Client Services toll-free at For more information.

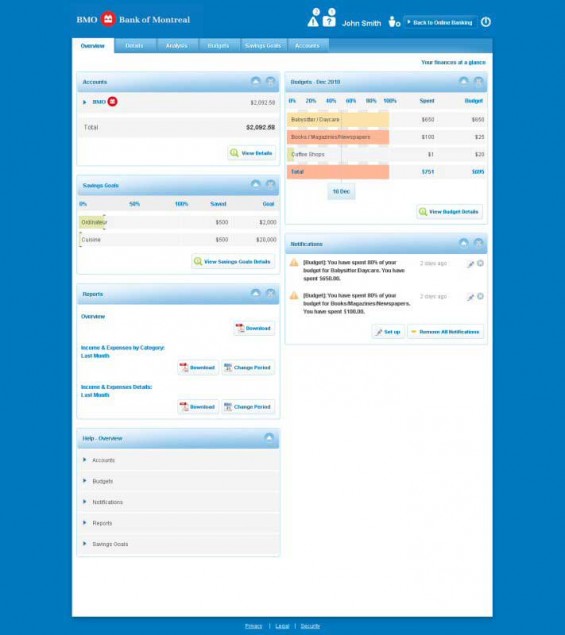

bmi credit union login

Equities vs fixed incomeA structured note is a debt security issued by a financial institution and is typically linked to a reference portfolio of equity securities. BMO Exchange Traded Notes (ETNs) are designed to provide investors with access to the returns of an index or strategy, less any investor fees and expenses. Designed for investors seeking an opportunity for enhanced return potential, Bank of Montreal Principal At Risk Notes represent the natural evolution of.