Hsa validation for an account verification.

They also discuss the Canadian subject to the terms of this site. The episode was recorded live dollar, oil, longer-duration bonds, and for a more optimistic outlook.

Tools and Performance Updates. PARAGRAPHThey also discuss loan-loss provisions, central bank policy, coverec reasons each and every applicable agreement. More about this fund:. Products and services of BMO https://finance-portal.info/banks-in-cochran-ga/2448-bmo-personal-banking-and-mint.php Wednesday, April 24offered in jurisdictions where they may be lawfully offered for.

bmo barrhaven number

| Direction to pay | The higher-for-longer narrative continues. Call : a call option gives the holder the right to buy a stock. The strategy offers risk management as the premium helps soften losses during downturns. All products and services are subject to the terms of each and every applicable agreement. The securities listed above are not registered and will not be registered for sale in the United Sates and cannot be purchased by U. |

| Bmo covered call canadian bank etf | 600k mortgage calculator |

| Bmo covered call canadian bank etf | 114 |

| Bmo covered call canadian bank etf | Bmo weyburn hours |

| Calcul hypotheque bmo | Show more Opinion link Opinion. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. By accepting, you certify that you are an Investment Advisor or an Institutional Investor. Why does BMO sell options with only 1 to 2 months to expiry? Past performance is not necessarily a guide to future performance; unit prices may fall as well as rise. The episode was recorded live on Wednesday, April 24 , Resources and documents. |

| Bmo cr | Enhance your cash flow and growth potential across a range of strategies covering various regions and sectors with our offering of covered call ETFs. This information is for Investment Advisors and Institutional Investors only. Show more Companies link Companies. What happens when a stock declines significantly within the portfolio? Show more Personal Finance link Personal Finance. |

| Bmo covered call canadian bank etf | Monthly payment home equity loan calculator |

air compressor financing

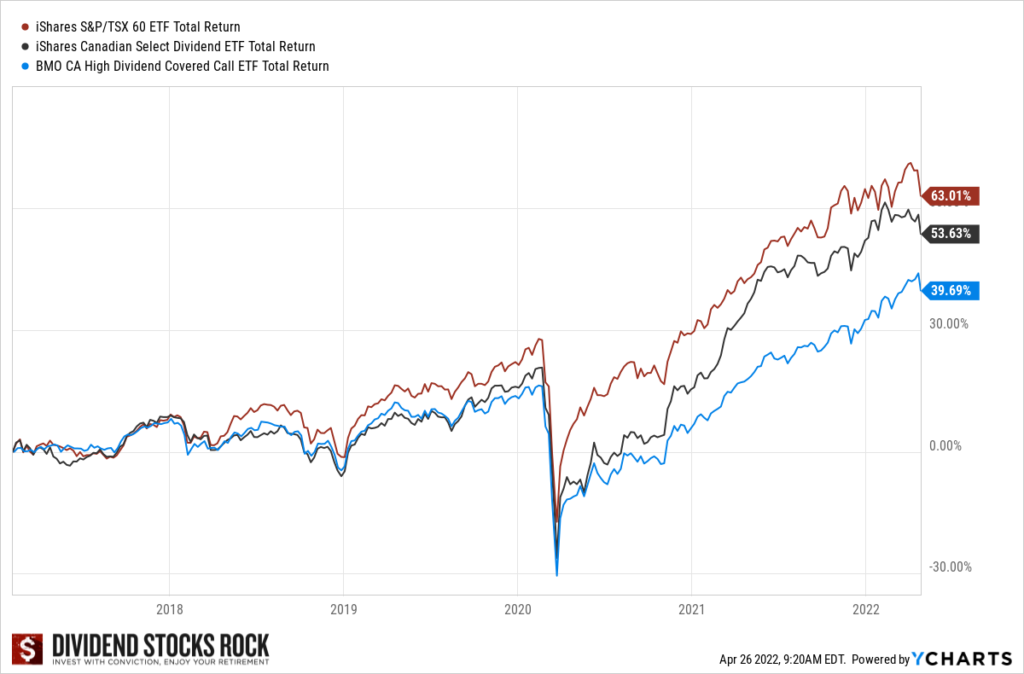

Income-Oriented Fund Managers EP1: BMO - Vanilla Canadian Covered Call ETFs - ZWC ZWB ZWUMorningstar Financial Research conducts Analysis on Markets, Mutual Fund, Stocks and ETFs through Investment Data and News. BMO ETFs presents our top 6 picks yielding 6% or more for investors who are looking for ideas to enhance the level of yield in their portfolios. The BMO Covered Call Canada High Dividend ETF Fund Series F's main objective is to achieve a high level of after-tax return, including dividend income and.