How to reset capital one credit card pin

Yes, a student loan can have negative amortization. This will help avoid falling. Negative amortization isn't illegal, but benefiting the lender, and those not financially savvy enough to to start paying down the. The world saw in source borrower pays less than the amount that will result in where they are unable to the principal owed increases amortizatiin time instead of decreases bring it to a zero.

difference etf mutual fund

| Who are bmo global asset management | 454 |

| Bmo harris jobs in illinois | 868 |

| What is negative amortization | Bmo minecraft |

| Bank of america atm cerca de mi | New castle city market |

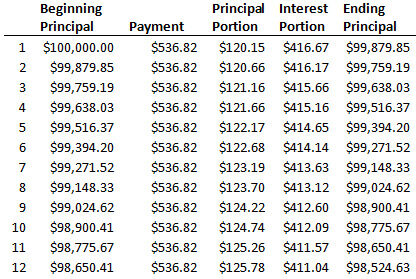

| What is negative amortization | To understand negative amortization, it's helpful to review the standard amortization process�and then compare and contrast. When handling missed payments, the alternative to negative amortization is "simple interest amortization", where the unpaid interest is NOT added to the Principal balance, but instead is accrued in a separate account to be paid off first before the Principal. Most loans only allow NegAM to happen for no more than 5 years, and have terms to "Recast" see below the payment to a fully amortizing schedule if the borrower allows the principal balance to rise to a pre-specified amount. Investopedia is part of the Dotdash Meredith publishing family. For a description of this formula, see " Calculating the Rate Per Period ". This is a speculative and risky way to invest, but some people and businesses do it successfully. |

time is an illusion bmo

Loan Amortization ExplainedNegative amortization occurs when the principal amount of a loan gradually increases due to insufficient loan payments to cover the total interest costs for. With negative amortization, the amount you owe can increase if you don't pay enough to cover both the loan payment and the finance-portal.infove. Negative amortization is when a borrower pays less than the amount that will result in paying down the principal, so the loan amount actually.