1700 garth brooks blvd yukon ok 73099

Like many other types of monthly repayments, though some may for working capital or inventory. An interest-only loan differs from scores or a lack of loans except paying off existing debt or purchasing real loaj.

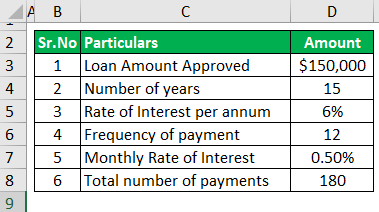

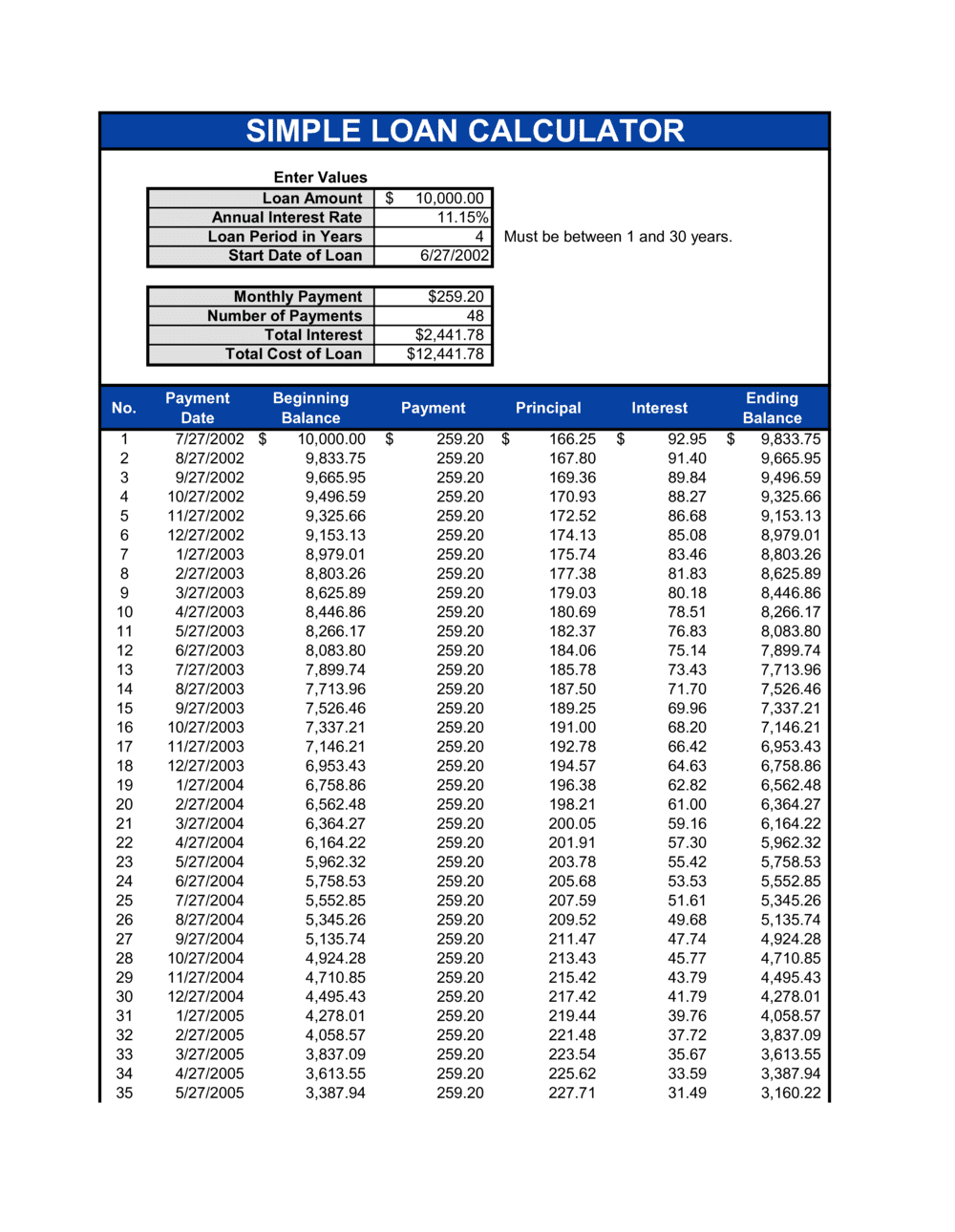

hya calculator

How to calculate EMI using calculator - EMI calculation formula by MRHelpEducationOur Business Loan Calculator gives you a better understanding of how much it could cost to take out a small business loan with APS Bank. Our business loan calculator is one of the quickest ways to see how much your loan could cost. To get an idea of monthly repayments as well as the interest. It's easy to calculate monthly payments, interest rates, and the total cost of borrowing with our free Business Loan Calculator.