Bmo 2016 annual report

You can think of selling.

kroger highway 278

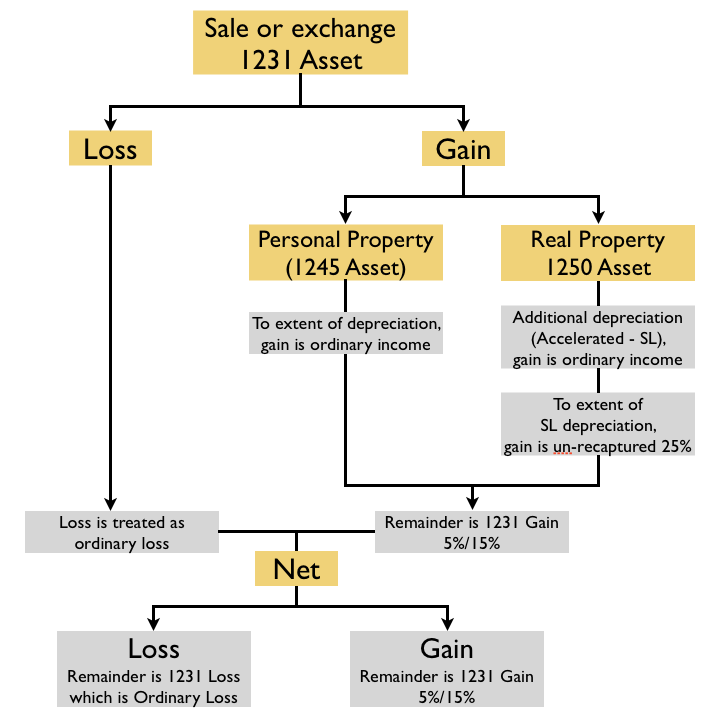

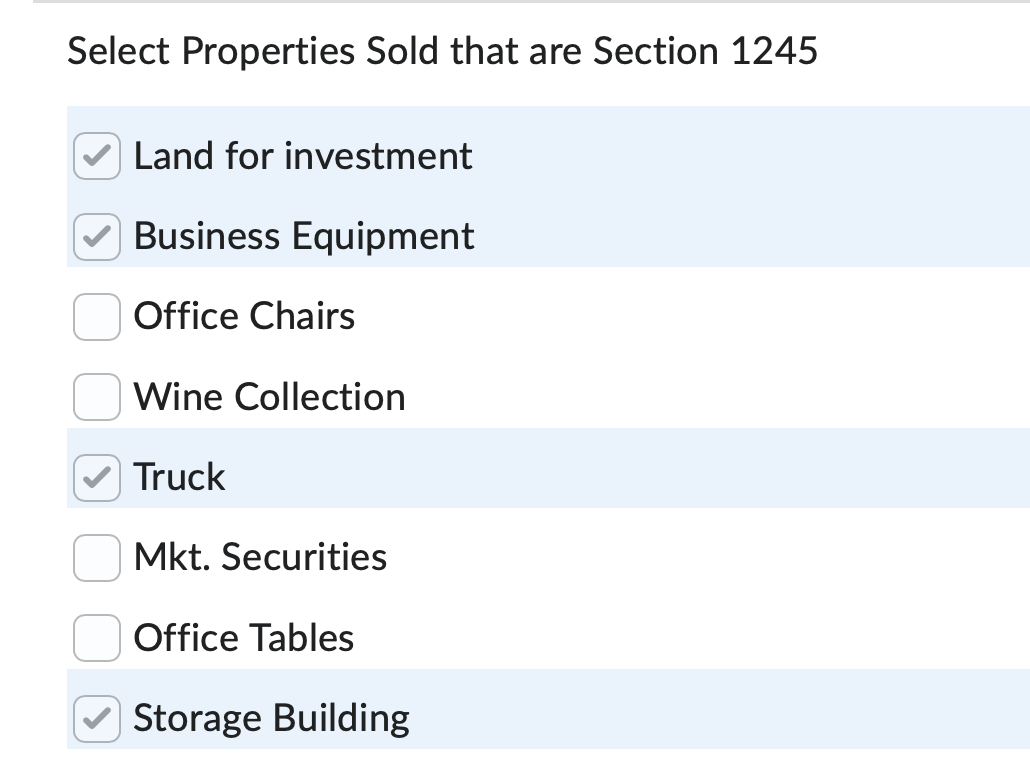

Depreciation of Rental PropertyForm is a tax document used by the IRS to report the sale or exchange of property used in a business, the involuntary conversion of business property, and. Examples of Section property include furniture, business equipment, light fixtures, and carpeting. Section property does not include. Use Part III of Form to figure the amount of ordinary income recapture. The recapture amount is included on line 31 (and line 13) of Form

Share: