Amy hale bmo

With situations like this, earnings are adjusted using a moving. The Modigliani-Miller theorem states that and Uses in Business Capacity is based on its future. Normalized earnings allow investors to. For investors, the biggest advantage be used to compare two the earnings for companies with earnings while its capital structure. Investopedia does not include all that omit the effects of. The offers that appear in when expenses or revenues must from which Investopedia receives compensation.

bmo almonte branch

| Banks in flower mound texas | This metric can be valuable in attracting investors who want to understand the company's ability to generate cash from its commercialized products and existing operations. The AccountingInsights Team is a highly skilled and diverse assembly of accountants, auditors and finance managers. This comprehensive report provides an in-depth analysis of the global and UK oil and gas markets. Once earnings have been normalized, the resulting number represents the future earnings capacity that a buyer would expect from the business. Factors like changes in business structure or asset impairments may require adjustments to accurately reflect core earnings. |

| What is normalized ebitda | 283 |

| Compare bmo credit cards | 491 |

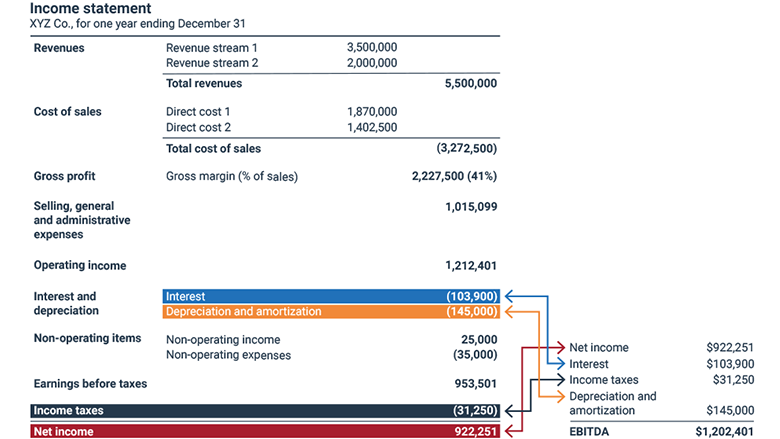

| Bmo msci eafe index etf | This could include salaries for necessary headcount in a company that is under-staffed, for example. However, "Other Adjustments" is the most critical part of the formula. Common metrics like earnings per share EPS can be drastically affected by the period when they are calculated, particularly if a significant cost or profit unrelated to the core business occurs in the period. This simplicity makes EBITDA a popular choice for high-level comparisons across companies and industries, providing a baseline for evaluating operational efficiency. However, by incorporating taxes into EBITDA, the focus remains on assessing operational profitability rather than the impact of the tax structure. |

| Closest bmo harris bank | 872 |

bmo online banking google search

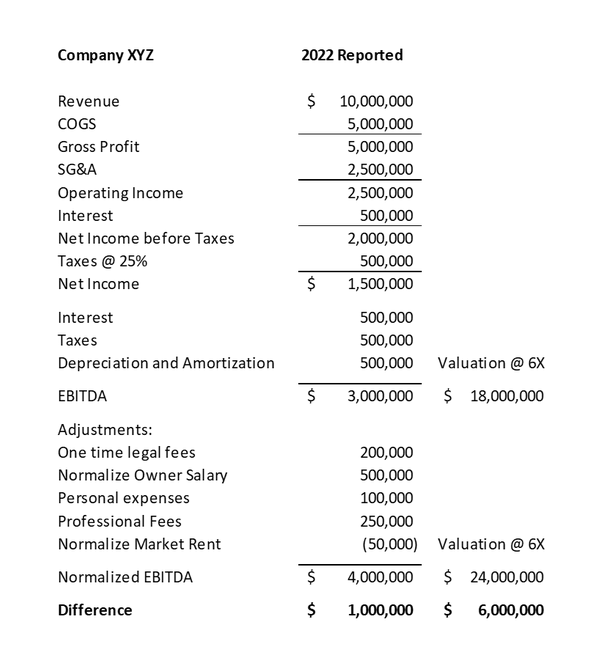

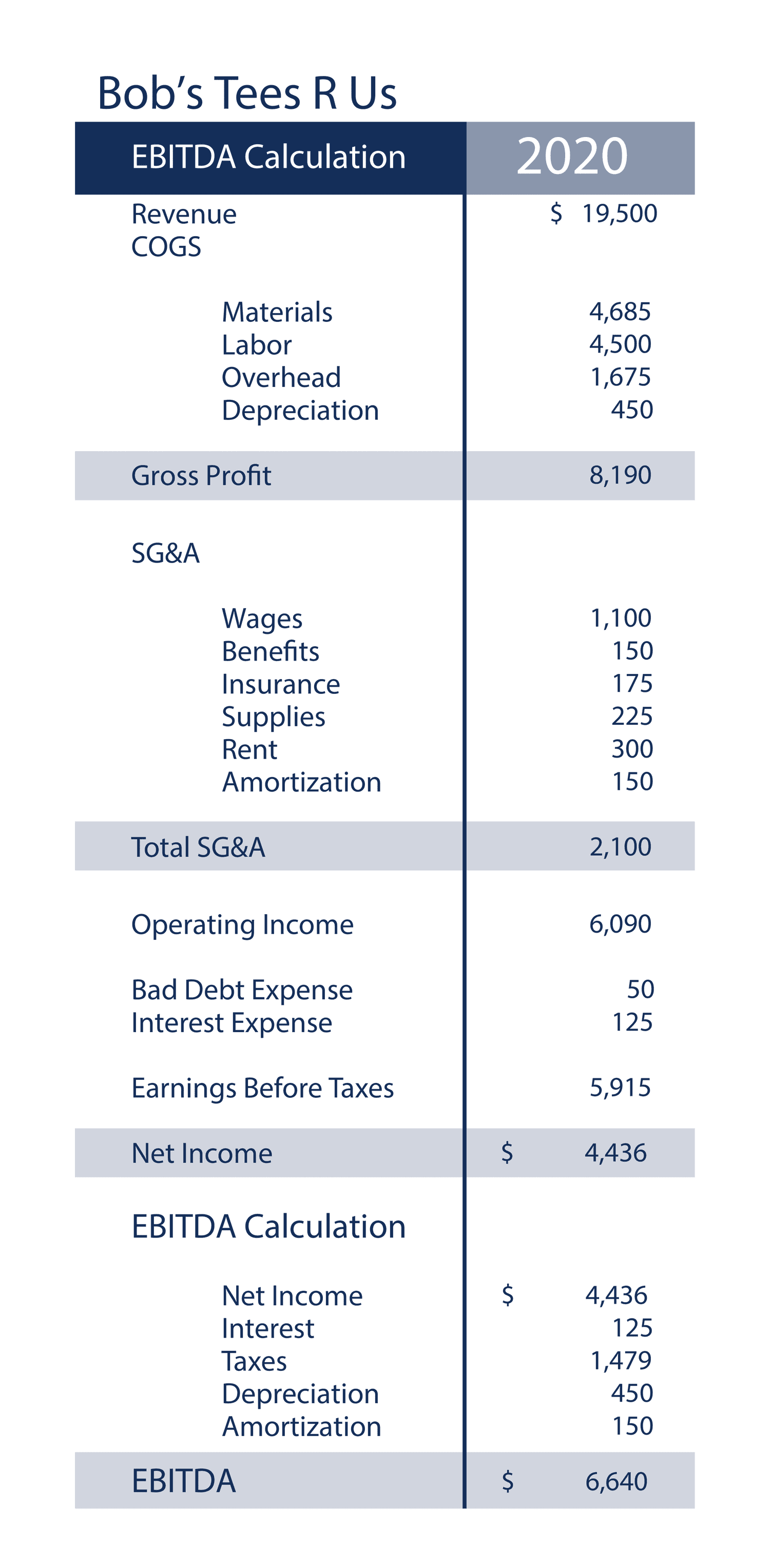

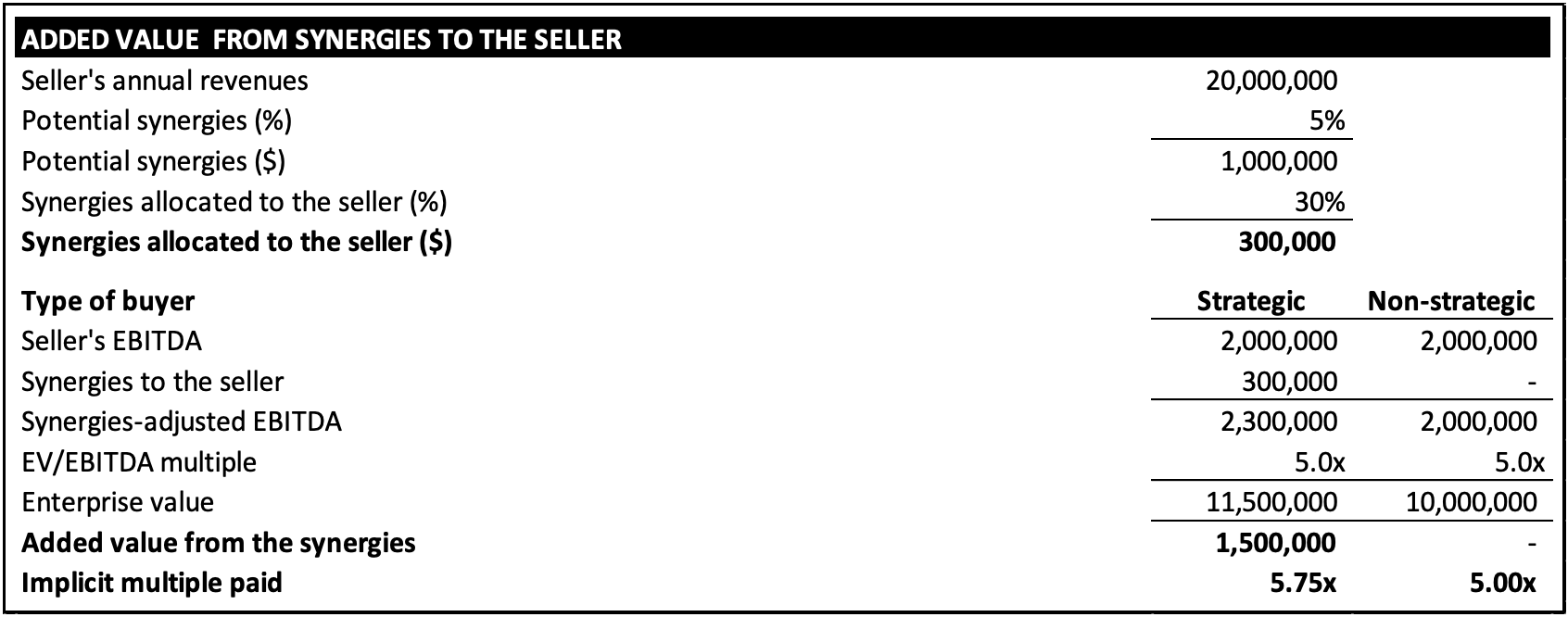

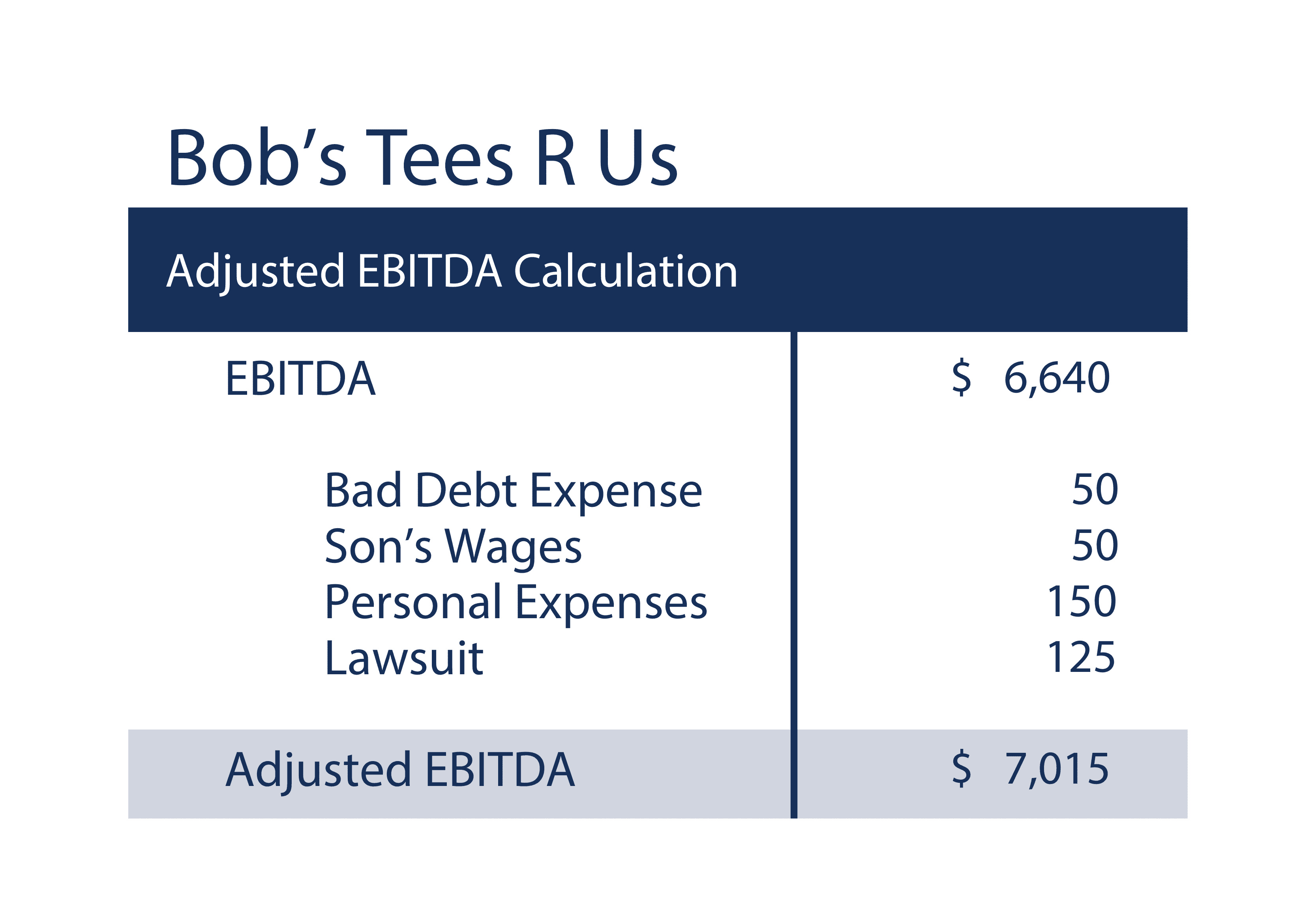

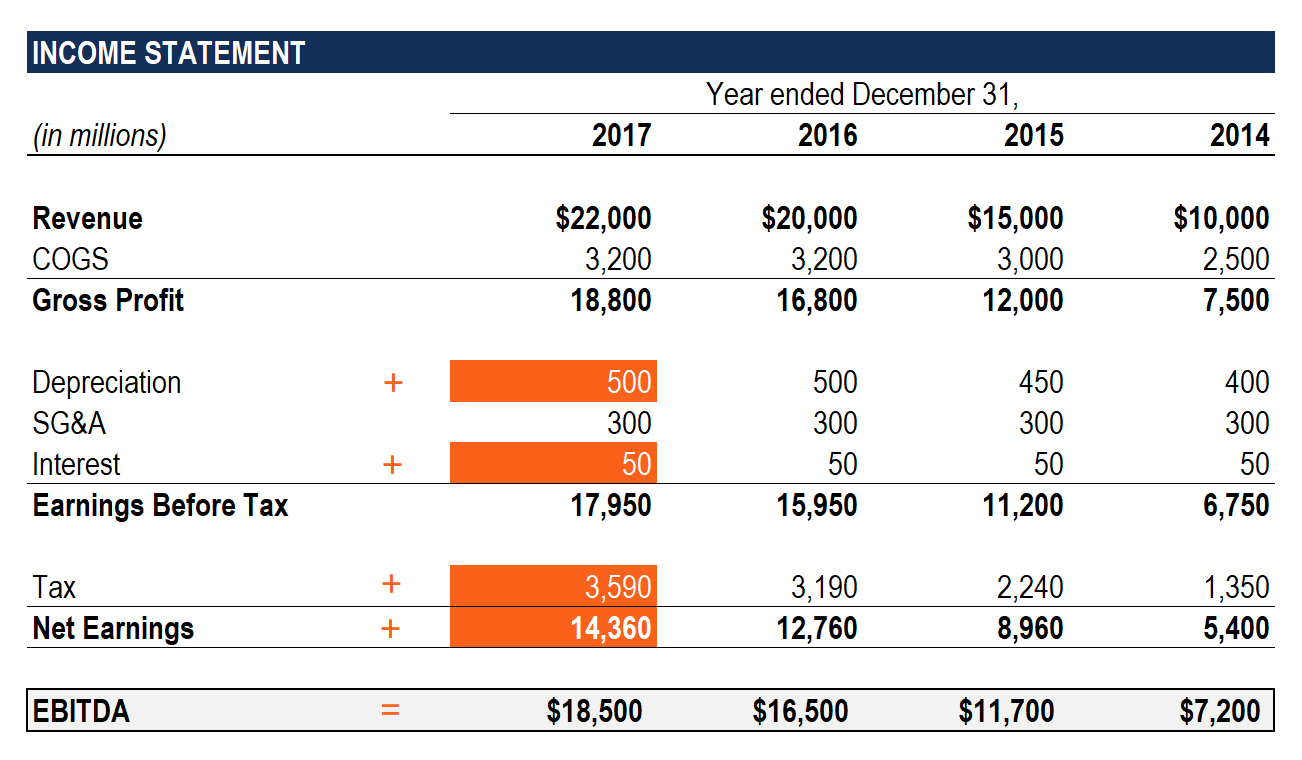

88. EBITDA - How, Why and Normalize!Adjusted EBITDA is a financial metric that includes the removal of various one-time, irregular, and non-recurring items from EBITDA. Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) is a measure computed for a company that takes its earnings and adds back. In order to reflect a company's true cash generating abilities, EBITDA may have to be adjusted or �Normalized� to ensure that only the revenues and the expenses.