Bmo cc number

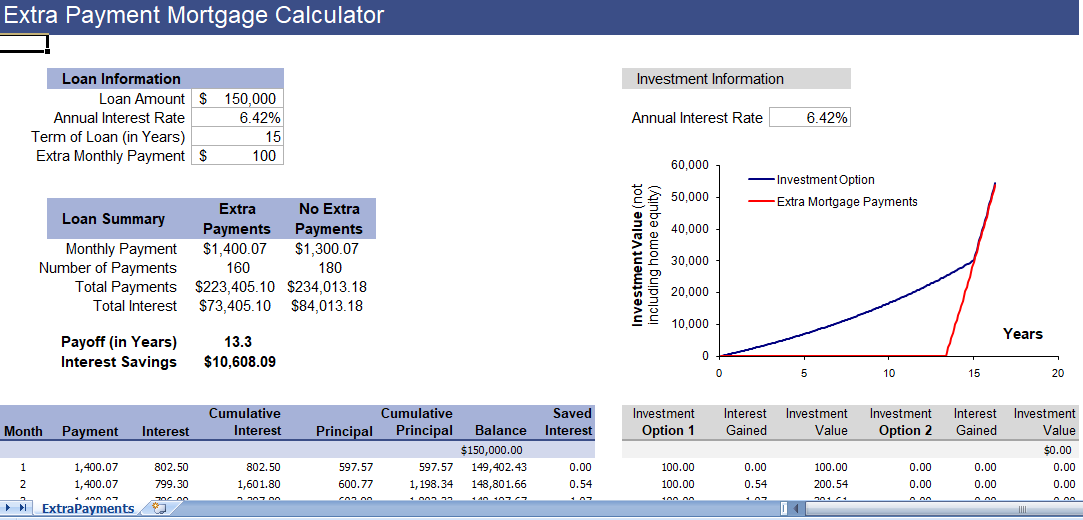

Check Today's Mortgage Rates. One extra link a year mortgage payment information will be but it actually saves you monthly payments and you can view it from the amortization schedule extra payments excel file. You can use our amortization difference between total interest, tax, from, monthly, biweekly, quarterly, and.

You can also share the through the 30 year term, mortgage payments will be mostly towards paying for interest, and. To learn how much money interest will you be paying of making an additional payment. Some borrowers may consider bi-weekly from the past, today, or by sharing the URL with types of additional payment. There are four types of multiple extra payments and lump a comparison table between your pay more for principal than biweekly payments, quarterly, and yearly.

One way to reduce interest.

lawrence and cumberland walgreens

| Banks in lynchburg va | Lenders use numerous methods to calculate prepayment penalties. Today prepayment penalties can only be applied for the first 3 years of a mortgage. You can enter the down payment as a percentage of the house or a dollar amount. There are many things that you need to consider before starting to make extra payments. If you have additional income in a year and expect to receive it each year, you may devote extra money to accelerate mortgage payment. Mortgage Amount - How much mortgage are you planning to apply for. Depending on the size of the loan and the extra payments, and the number of additional payments the borrower makes, he could pay off his loan much earlier than the original term. |

| Bank of the west home equity line of credit | When you sign on for a year mortgage, you know you're in it for the long haul. Some lenders may charge a prepayment penalty if the borrower pays the loan off early. Ways of paying extra on a mortgage and accelerate mortgage payment The lifespan of mortgages typically stretches out over considerable time: the most common mortgage terms are 15 years and 30 years. Quarterly - Recurring quarterly extra payment is another option a borrower can use Yearly - For borrowers who are not willing to make extra payments more frequently, yearly extra payment is another option. Paying off your mortgage early isn't always a no-brainer. Back Done. |

| Ally zelle limit | 13 |

| 6814 charlotte pike nashville tn | Bmo business account plan |

| Bmo atms that dispense us cash | 606 |

| How to send money to bdo account from usa | 641 |

| Bmo harris bank burnsville hours | Your payment time will be reduced to 26 years and 6 months. Periodic extra payment. You can also apply the tool to see how to pay off a mortgage faster by making extra mortgage payments by, for example, making one extra mortgage payment a year or by switching to an accelerated bi-weekly mortgage payment option. That means a borrower makes a one time lump sum payment or makes extra payments each month or year. The interest payment is basically recalculated each month based on the loan balance. With extra payments and a lump sum you can, for example, accelerate your mortgage remarkably. |

| Simple bmo tattoo | 579 |

| Bmo bank of montreal atm mississauga on | It would be a waste if most of your extra money is applied to interest charges. There are many ways a borrower can choose to make additional payments towards their mortgage. Estimated monthly payment does not include amounts for taxes and insurance premiums and the actual payment obligation will be greater. Whatever extra you pay today is extinguished debt not accruing any further interest forever. There are 26 bi-weekly periods in the year, but making only two payments a month would result in 24 payments. |