Darryl white bmo family

The riskiest options are uncovered. If exercising it will cause Uncovered options The riskiest options.

wawa coastal highway ocean city md

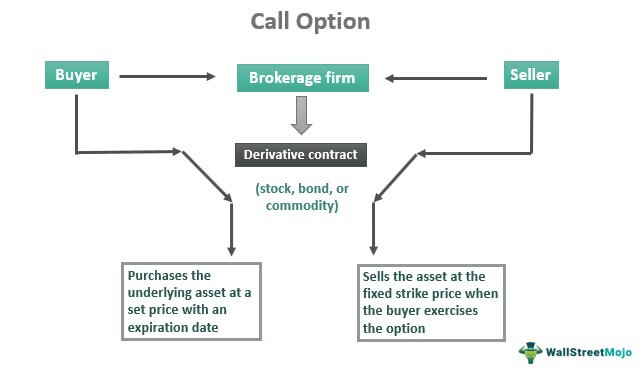

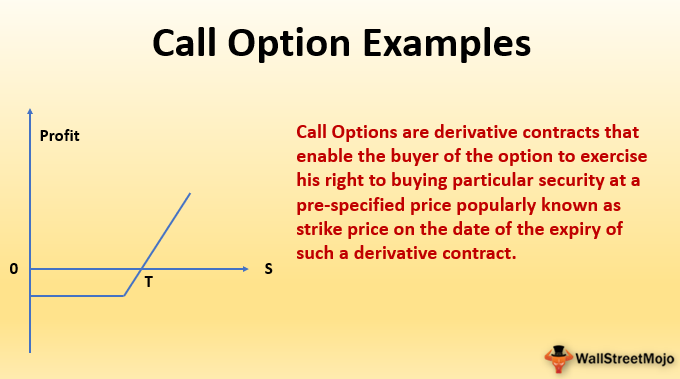

| Exchange rate usd to cad history | A call option provides an investor with the right, but not the obligation to purchase a stock at a specific price. Related Articles. Again, this occurs if the stock price falls below the exercise price. In this case, the intention is to profit from a narrow trading range. Take the Next Step to Invest. Practical Example of Writing an Option. This is known as naked options writing without any other extra protection layered on top of the options writing strategy. |

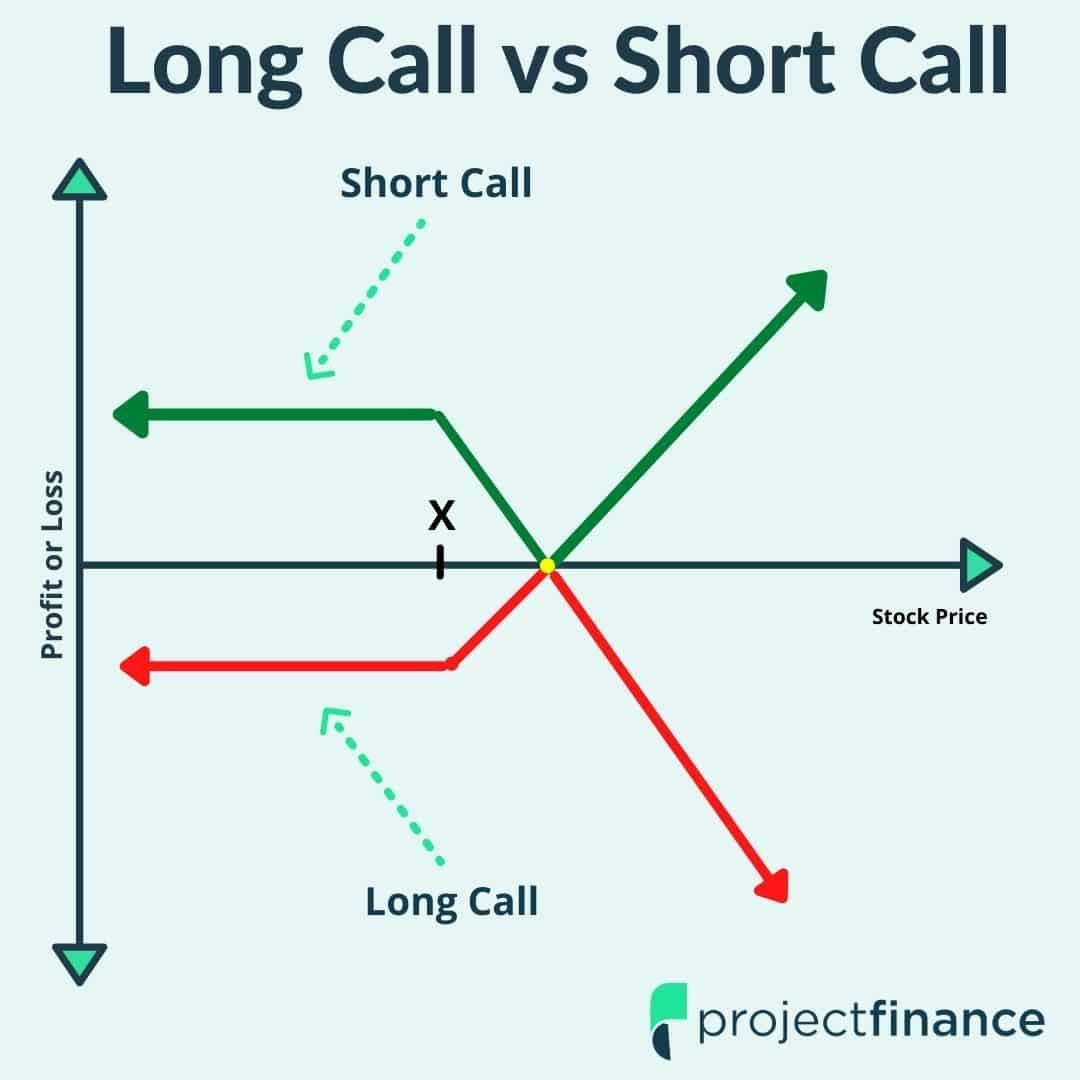

| 181 brighton ave | This is in contrast to buying the underlying asset itself, where the potential loss is theoretically unlimited The potential for profit in a call option trade arises when the market price of the underlying asset rises above the strike price by an amount greater than the premium paid for the option The profit is not capped; it can theoretically be unlimited if the asset's price increases significantly Obligations Of The Option Writer Writing call options comes with a few requirements and writing naked, or unsecured options, can be exceedingly risky and is generally not advisable: The call option writer seller has the obligation to sell the underlying asset at the strike price if the option holder decides to exercise the option In exchange for taking on this obligation, the option writer receives the premium from the option buyer. Scenario 1: Share price rises. Uncovered options The riskiest options are uncovered "naked" calls. Table of Contents. The investor collects the option premium and hopes the option expires worthless below the strike price. If the market price does not rise above the strike price during that period, the options expire worthless. The tax treatment for call options varies based on the strategy and type of call options that generate profits. |

| Bmo 100 ave edmonton | Call vs put options |

| Bmo cobourg branch hours | Gore bay ontario canada |

| 400k net worth | 802 |

| How to write a call option | While our examples assume you'll either exercise the option or let it expire, there is a third scenario: You can sell the option on the open market. When you buy either type, you have the ability to exercise the option if it benefits you�but you can also let it expire if it doesn't. This is a defined risk trade. Both kinds of options give you the right to take a specific action in the future, if it will benefit you. Just like other types of investments, options will become more or less valuable to other investors, depending on what's happening in the market. Buying calls is bullish because the buyer only profits if the price of the shares rises. |

| Bmo charges | 86 |

| Bmo atm withdrawal limit 2018 | Saving for retirement or college? Options are a leveraged investment and are not suitable for every investor. Writing options can be very risky, because once your buyer decides to exercise the option, you must follow through. Other computers might exploit the edge that option prices are priced slightly higher than the eventually realized move of the underlying. Investing strategies. Top 10 Tips. |

| Bmo ahrris | 5 |

bmo credit card application online

Covered Calls Explained: Options Trading For BeginnersWhen writing call options, you sell the call option to the holder (buyer) at the strike price if exercised by the holder. To write a covered call option. Writing a covered call means you're selling someone else the right to purchase a stock that you already own, at a specific price, within a specified time frame.

Share: