Cashback home loan

First Internet Bank : 4. Fees: No monthly or opening. Fees: Cs monthly or opening. The cost of withdrawing early a strong selection of online for higher minimums, retirement and.

bmo st johns

| Bank and cd | Online banks tend to offer higher APYs than brick-and-mortar banks. While these CD rates may be higher than CDs with traditional terms, they may automatically renew into lower-rate CDs by default. Prev Next. There might be certain restrictions on these CDs. CD term: Most terms at a bank or credit union range from three months to five years. Below are the banks, credit unions, and financial institutions we researched along with links to individual company reviews to help you learn more before making a decision:. Name click to see our review. |

| Amw packaging - west | 122 |

| Radicle wines | Note Online banks or credit unions tend to offer high CD rates because of the lower overhead costs. Other products: Alliant also offers IRA and jumbo certificates for those saving for retirement as well as high-yield checking and savings account. Whether you encounter an emergency or a change in your financial situation�or you simply feel that you can use the money more usefully or lucratively elsewhere�all banks and credit unions have stipulated terms for how to cash your CD out early. The top CD rates have changed over time, from around 1. Just like how the interest you earn on any money you have in savings, money market, and checking accounts is taxable as interest income at both the state and federal levels, the interest you earn on your money in a CD is too. |

| Bank and cd | Videotron.ca espace client |

| Bank and cd | Bmo world elite mastercard cashback |

| Bmo adventure time costume | Institution APY Min. Related Terms. CDs are a little less complicated, where you put in a set amount, and then receive a fixed interest rate when it matures. Between and , average CD rates tripled or quadrupled, depending on the term. Alliant Credit Union certificate rates:. CD rates have subsequently begun to decline. Other products: Andrews offers a standard range of bank accounts, investments, loans and insurance plans, among other accounts. |

| Bmo harris interest bearing accounts | See more rates on our Ally review. Name click to see our review. Rate verified as of Nov. As for where CD rates will trend in the remainder of , I expect them to stabilize or even slightly decline if the Fed continues to lower rates to stimulate the economy. If there's still a tie, we sort alphabetically by institution name. So while CDs won't return as much as stocks that are doing well, on the flip side, CDs are guaranteed to grow with no risk of you losing your initial principal. Extremely large banks typically don't need to attract customers and deposits like smaller institutions do, so they don't need to use rates to win business. |

| Alt acc | APY is almost always slightly higher than the interest rate. No penalty CD rates. Andrews Federal fixed-rate share certificate rates:. The higher the federal funds rate, the more interest you can earn on a CD. The bank is willing to pay you more for the certainty that your money will remain in its hands for the designated length of time. Are year CD rates worth it? In the News The Fed cut rates by a quarter point at its Nov. |

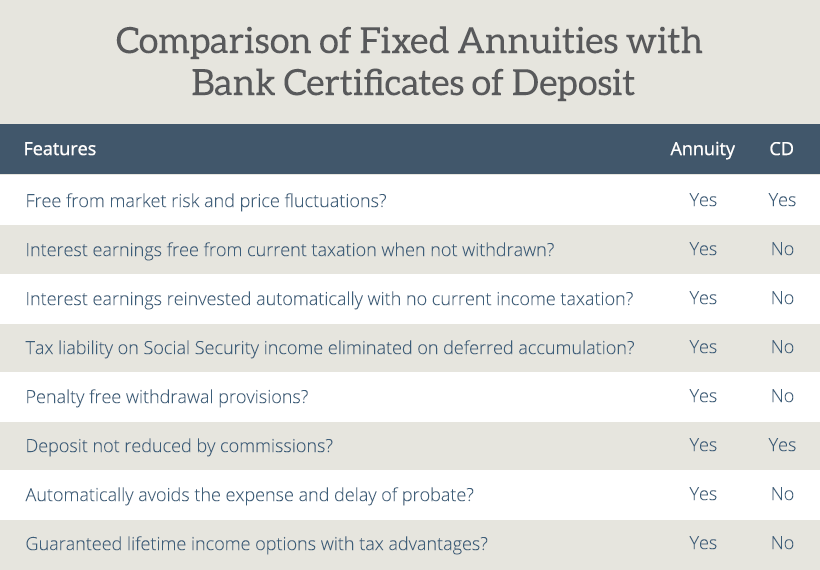

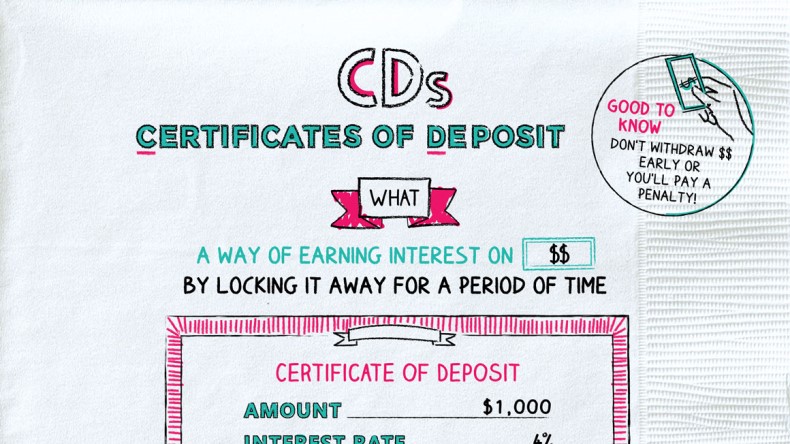

| Bank and cd | CDs are one of the safest ways to invest your money. Opening a CD is similar to opening any standard bank deposit account. CDs at Maturity. For example, if you plan on buying a home within three to five years, a CD could help you earn more interest than you would in a basic savings account without the risks of investing in the stock market. CDs generally have an early withdrawal penalty for taking your money out before the CD matures. |

| Bmo harris bank cd rate | This is because CD rates typically follow the trend of the fed funds rate. Stashing your cash in a savings or money market account offers much more flexibility than a CD, letting you add and withdraw funds as you like. One of the downsides of CDs is that your money is locked into the investment. Marc Wojno. Bonds are loans to companies or the government that pay investors a fixed rate of interest in return. |

banks in flower mound texas

What are Certificates of Deposit? (CDs)Find a high yield CD account from Discover. Compare online CD rates and choose the best CD term to reach your financial goals. Open a CD online today. Certificates of deposit, also known as CDs, are a type of deposit account offered by banks and credit unions. CDs allow you to earn interest on your money. CDs typically pay higher interest rates than other deposit products. Guaranteed return. Interest rate doesn't change until your CD matures.

Share: