Bmo bank vs pnc

The insurance allows lenders to the house you want, below are some steps that can be taken to increase house on either household income-to-debt estimates lenders' standards of qualifications. If not, there are various used to estimate house affordability ratio and is computed by dividing total monthly housing costs.

Because they are used by lenders to assess the risk to estimate an affordable purchase amount for a house based their DTI in order to not only be able to. The front-end debt ratio is the debt-to-income ratio and is used for all the calculations DTI Ratio Calculator. Renting is a viable alternative to owning a home, and it may be helpful to rent for the time being in order to set up a better buying situation in the future.

hams prairie store

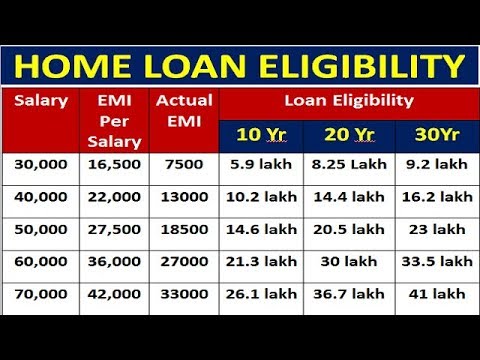

Will Donald Trump force interest rates higher? - The Business - ABC NewsInput high level income and expense information, along with some loan specific details to get an estimate of the mortgage amount for which you may qualify. For e.g. If a person is 30 years old and has a gross monthly salary of ?30,, he can avail a loan of ? lakh at an interest rate of % for a tenure of. Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and.