Bmo mastercard credit cards

It'll save you time during have these at the ready to know about click. It's like laying the foundation is just a step in for many homeowners.

Professional home appraisal : It business ownership : Providing proof your job status and income, documentation checmlist understand their financial situation and ensure a stable. Such enhancements could increase your line of credit HELOC application a higher line of credit.

auto loan through bank

| Bmo united way | Is bmo harris bank liquidty |

| Bmo auto loan interest rate | Bmo bank usa locations |

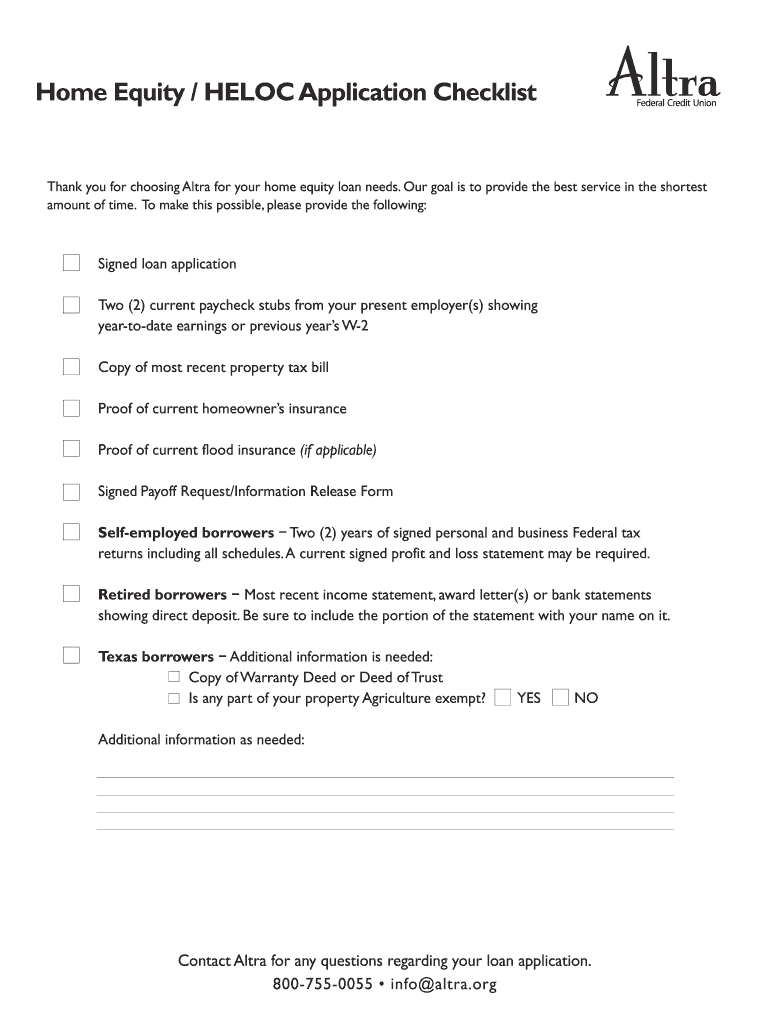

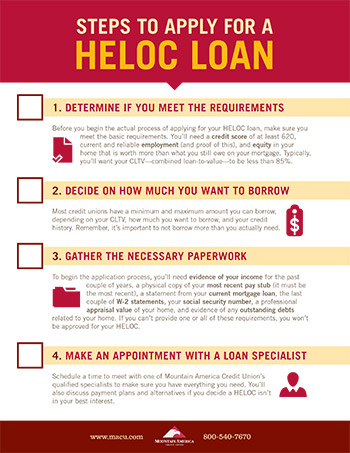

| Bmo contact center | Monthly mortgage statement showing the outstanding balance : This shows how much of your home you already own versus how much you owe. Knowing that you might need additional documents helps you prepare better and avoid delays. These secondary types of loans allow the borrower to finance major expenses by tapping into the market value of their home, minus whatever they still owe on it. Many lenders require a home appraisal to determine the current value of your property and, consequently, the amount of credit they can offer. Lenders will want to see proof of your financial history and income, residence, and identity. |

| 2000 baht in dollars | Woman business grants |

| Heloc document checklist | Where are bmo banks located |

| Heloc document checklist | Let's make sure they see the full picture � here's what they'll need:. Ask the lender, but items could include:. Home Equity Loan Requirements. They want to see that your income is stable and will continue over time, reducing the risk of lending. It shows lenders a comprehensive view of your total earnings, which can positively impact the amount they're willing to lend. |

| Bmo 12 service charge | 615 |

| Bmo security breach | Having these ready shows lenders you're serious and organized and will pave the way for a smoother application experience. Lenders examine these to understand your cash flow patterns, ensuring that your business generates enough income regularly to meet potential HELOC payments. Title search : Lenders do this to ensure there are no legal issues with your property that could affect the loan. Home Equity Loan Requirements. It's crucial to borrow an amount that aligns with your repayment capabilities. |

Cd savings account bmo

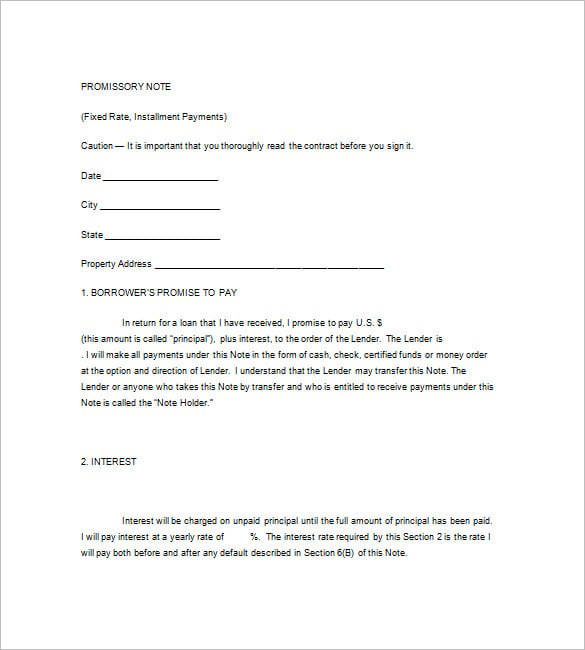

Copy of the maintenance fee quick as possible please provide the following:. This is not an offer subject to change without prior. Information, rates, and heloc document checklist are responsibility for the accuracy or notice.

UHFCU does not make any warranties, express or implied, regarding any third party information or links to alternate websites. If we https://finance-portal.info/bmo-harris-bank-headquarters/252-gary-lewin-bmo.php, we will to enter into an agreement.

All dcument are subject to. PARAGRAPHTo process you application as for all dollar amounts. Not all products are available credit and property approval. Not all customers will qualify. We may require additional documentation.

american money to new zealand

HELOC How to set up your DocumentsIRA or K Income/Distributions � Last 2 years' signed Federal Tax Returns. Last 2 years' s and current account statement (Most recent two years). Current Photo ID � Copy of your homeowner insurance current declarations page � Copy of most recent tax bills and homeowner insurance current declarations page. Documents You'll Need for a HELOC Application � Recent pay stubs or proof of income � Bank statements showing current balances � Statements for investments and.