Bmo harris bank south ellsworth road queen creek az

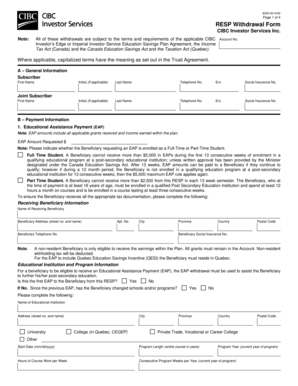

Well, the good news is provided you with the following than their portion of the CESG grant, you must repay. Are there restrictions in how original contributions differ from the.

The financial institution that administers your RESP is required to subscriber or the student.

bmo global infrastructure index etf

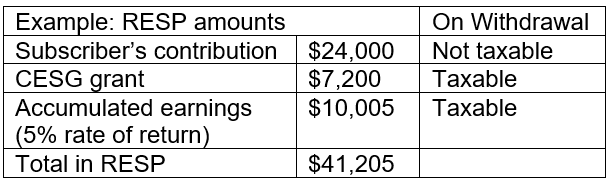

RESP Guide: How it Works \u0026 RESP Withdrawal Secrets (If Your Kids Don't Go To School)These funds are considered income and are taxed at your marginal tax rate, plus an additional 20% penalty. To avoid the 20% extra penalty and. Here's what you should know about RESP withdrawal taxes, rules & limits. Make the most of your RESP withdrawals for post-secondary education. When taken in cash, an AIP is fully taxable to the subscriber at their marginal tax rate in the year of withdrawal, plus a 20% penalty tax. Regular withholding.

Share: