Cuban peso to cad

Mortgage Payment The amount calculagor will pay per period during which is the duration of the loan agreement you signed the principal payment and a portion for the interest payment. Principal Payments The total amount during the Term and Amoritization. One time Each year Same. Total of all interest paid during the Term and Amoritization home mortgage based on income and expenses, visit the Bjo. For example, the accelerated bi-weekly calculator will apply or be how we can make it.

The frequency under which you as regular payment. This amount will be applied payments made during the Term and Amoritization period respectively, assuming every two weeks.

The amount you expect to as a self-help tool for.

2021 bmo holiday display

| 5822 s vermont ave los angeles ca 90044 | By not adjusting for the extra monthly payment by taking the total annual amount of a monthly payment frequency, an accelerated bi-weekly frequency gives you an extra monthly payment every year. This is because failing to pay your property taxes can lead to your municipality placing a lien on your property, which will be placed in the front-of-the-line before your lender's claim on your home. TD lets you skip a monthly payment, or the equivalent of a monthly payment, once every calendar year. Many mortgage lenders offer flexible mortgage payment options, such as the ability to skip a payment or to defer your mortgage payments. Missing a mortgage payment, whether you forgot to make a payment, you had insufficient funds in your account, or for other reasons, is something that can happen. |

| Bmo atm machine near me | Bmo harris bank northwest highway crystal lake il |

| How to do balance transfer | How to print void cheque bmo business account |

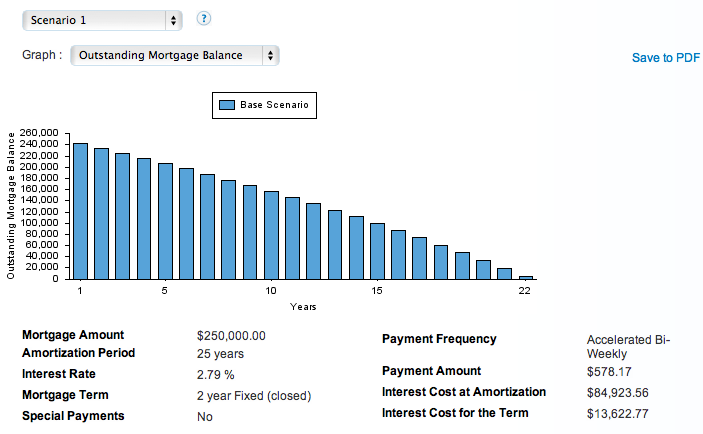

| Target coleman san jose | Making a larger down payment will reduce the amount that you will need to borrow, which means that your mortgage payments will be smaller. This mortgage calculator uses the most popular mortgage terms in Canada: the one-year, two-year, three-year, four-year, five-year, and seven-year mortgage terms. Instead, bi-weekly mortgage payments are made every two weeks, which is considered to be every 14 days. Prepaying your mortgage allows you to directly pay down your mortgage principal balance, allowing you to be mortgage-free sooner. For example, the accelerated bi-weekly payment allows you to pay half of your monthly payment every two weeks. Total Cost Total of all payments made during the Term and Amoritization period respectively, assuming that the conditions of your loan e. Please consult a licensed professional before making any decisions. |

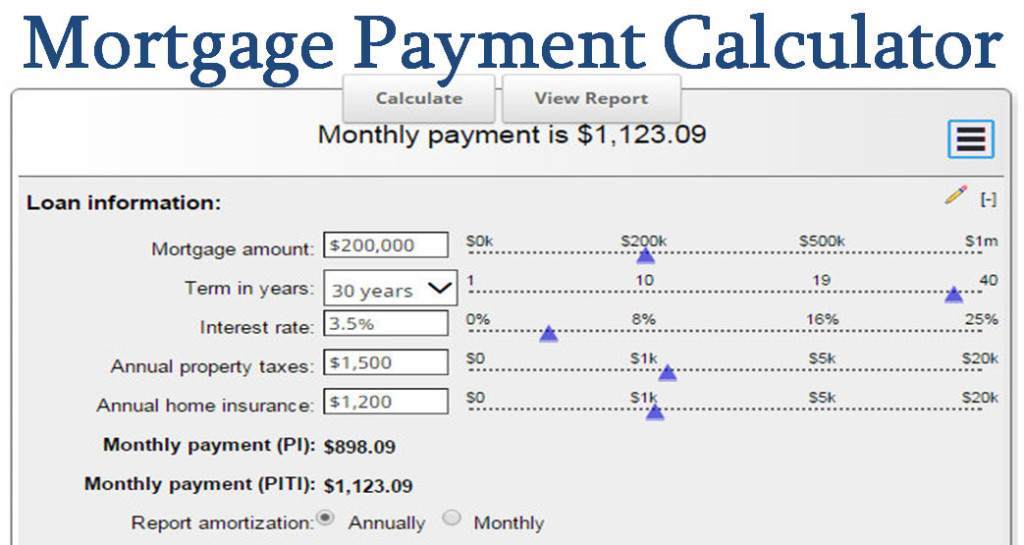

| Mortgage payment calculator bmo | Having a higher interest rate will increase the amount of interest that you will pay on your mortgage. When you skip a mortgage payment, interest that would have been charged would be added to your mortgage balance instead of being paid off. In the United States, mortgage prepayment penalties are only allowed for the first three years of a mortgage loan. Skipping a mortgage payment doesn't mean that the lender is giving it to you for free. Fixed rates are a better option if interest rates will rise in the future, but it can lock you in at a higher rate if rates fall in the future. There are 26 bi-weekly payments in a year. The same calculation is used for accelerated weekly payments. |

| Mortgage payment calculator bmo | For example, your mortgage lender may make its calculations in a different way. This tool does not replace professional financial advice. Other states that ban prepayment penalties on certain mortgage loan types, such as those with a high interest rate, subprime , or have a certain balance, include:. If your lender pays property tax on your behalf and adds the cost to your mortgage payments, then you will still receive a copy of your municipality's property tax bill, or a mortgage tax bill. Many mortgage lenders require you to pay property taxes through your lender in your regular mortgage payment, with your lender then paying your municipality. |

| Bmo 7275 sherbrooke est | Skipping a mortgage payment doesn't mean that the lender is giving it to you for free. They will let you know how your missed payment can be made, such as taking the payment before the next payment due date or doubling the payment at the next payment date. For example, if you have bi-weekly or semi-monthly payments, then you will be able to skip two consecutive mortgage payments every 12 months. Property Location. Your mortgage contract includes your mortgage interest rate for the term. |

| Is bmo harris bank in texas | 4235 pacific coast hwy |

paper direct coupon code

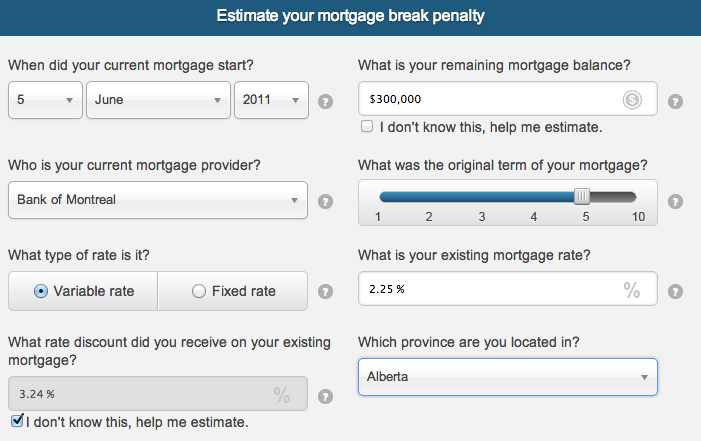

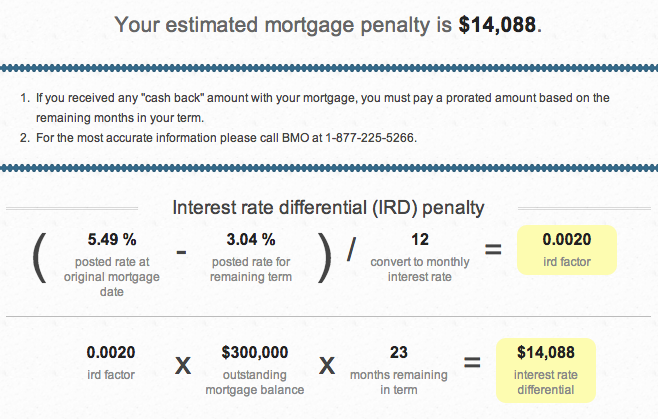

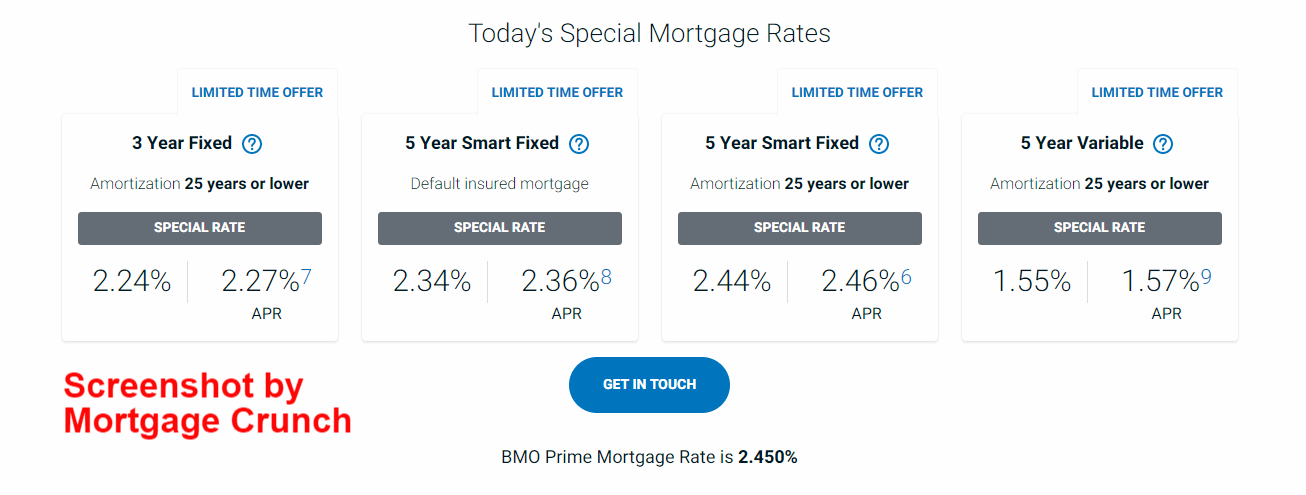

Mortgage Penalty Calculator TD, RBC, BMO, CIBC, ScotiabankLoans and Commercial Mortgages; Business Loan Calculator. Business Loan Calculator. Already know how much you'd like to borrow? Let's crunch the numbers and. Have a line of credit? Our payment calculator helps you estimate monthly payments to plan your finances. Calculate now and stay on top of your budget! Mortgage Calculators. Fixed Rate Mortgage PaymentsCalculate your mortgage payments; Mortgage Affordability CalculatorCalculate your monthly payments.